Did you know that there’s a direct link between your employees’ financial literacy and their overall wellbeing? By giving them the knowledge, skills, and confidence to make better financial decisions, you can reduce their stress levels, boost employee engagement, and improve their workplace performance too.

In this blog we explore the current state of financial literacy in the UK and explain why it should be a board-level concern. We’ll then provide some practical tips on how HR leaders can take meaningful action, and the advantages they can expect as a result.

In this blog

The UK’s literacy gap is worryingly high

What does a lack of financial literacy mean for your organisation?

What can HR leaders do to bridge the financial literacy gap?

Take the lead on financial literacy today – and reap the rewards

Conclusion and key takeaways

The UK financial literacy gap is worryingly high

According to the latest research by Aberdeen, over 23 million adults in the UK have poor financial literacy. Similarly, a survey by the UK’s Money Advice Service found that almost half of the UK population (47%) do not feel comfortable making decisions about financial products and services and over half (63%) do not feel they can determine what happens in their lives when it comes to money.

It’s a problem that starts young. The Money Advice Service research found that less than half (48%) of 7–17-year-olds believe they receive a meaningful financial education in school, at home, or in other settings.

This means that many people enter the workplace without any basic understanding of how to make sense of their earnings, tax, or pension contributions. In fact, our research found that a staggering 79% of employees are not fully confident that they understand every aspect of their payslip, or that they would be able to spot an error.

What does a lack of financial literacy mean for your organisation?

Employees’ lack of confidence around their finances can cause significant stress – and this can severely impact productivity at work. Global research by the World Economic Forum found that people with poor financial literacy could spend as many as 12 hours per week – including a significant portion of time spent at work – worrying about and dealing with personal finance issues.

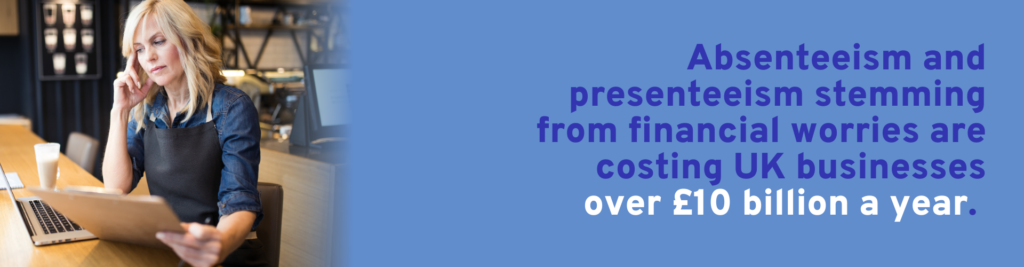

The business impact of this is huge, with the most recent research from the Center for Economics and Business Research (CEBR) suggesting that absenteeism and presenteeism (where employees are at work but not fully performing) stemming from financial worries are costing UK businesses over £10 billion a year – a figure that has risen year on year.

This means that financial illiteracy is not just costing your employees, it’s costing your business.

What can HR leaders do to bridge the financial literacy gap?

Improving your employees’ financial literacy doesn’t have to be complicated. Here are three actions you can take that can have a big impact on your employees’ financial wellbeing:

- 1. Make your payslips easier to understand

It sounds simple, but making your payslips easier to understand can make a huge difference to your employees’ financial confidence. By breaking down net pay, gross pay, and deductions into easy-to-understand visuals, for example, you can provide greater financial transparency.

- 2. Offer self-service support

More than half of UK employees are embarrassed about their level of financial literacy, according to a report by FT Adviser. With this in mind, it’s understandable that employees might feel apprehensive about asking their employer about their pay. Offering innovative digital payslip solutions with in-line FAQs and AI-powered chatbots can provide a psychologically safe place for them to get help, without putting additional pressure on HR.

- 3. Offer financial wellbeing tools

Providing financial wellbeing tools at the point of pay can enhance budgeting, payment flexibility, and savings. This can have a big impact on employee engagement and strengthens employer loyalty, resilience, and productivity.

Take the lead on financial literacy today – and reap the rewards

By improving financial literacy across your organisation, you can realise multiple benefits:

- You position your company as a socially responsible employer that is genuinely committed to employee financial wellbeing.

- You reduce employee stress, which translates to greater employee engagement – and increased productivity as a result.

When employees feel supported by their employer, their job satisfaction increases, as does their loyalty.

Conclusion: Financial literacy builds trust, resilience, and productivity

Investing in financial literacy builds a stronger, more resilient workforce. It empowers employees and builds trust – and that fosters greater productivity and job satisfaction.

Ultimately, when you commit to improving your employees’ financial literacy, you are not only doing right by them, but you are also doing right by your organisation.

Key takeaways

- Over 23 million adults in the UK have poor financial literacy.

- Many people enter the workplace without any basic understanding of how to make sense of their earnings, tax, or pension contributions.

- Employees’ lack of confidence around their finances can cause significant stress – and this can severely impact productivity at work.

- HR teams can bridge the financial literacy gap with some simple fixes like simplifying payslips, offering self-service support, and providing financial wellbeing tools.

- Companies that improve financial literacy can benefit from more productive employees and can foster greater loyalty.

Find out what you can do to raise financial literacy

Join our free webinar where you’ll discover the hidden cost of financial confusion – from payroll queries to lost trust. You’ll also learn about the practical ways you can boost payslip confidence and communication.