As the link between money worries and employee productivity becomes clearer, payroll has an important part to play in supporting a financial wellbeing strategy that reduces pressure on employees.

In this blog

Performance and financial wellbeing

How payroll supports financial wellbeing

Optimising payroll services for financial wellbeing

MyView PayNow financial wellbeing app

Work Report for employment and income verification

The link between performance and financial wellbeing

Research illustrates the connection between financial wellbeing and performance extensively.

A survey of 2,502 workers in the UK and Ireland found that 77% have experienced financial stress and anxiety over the last 12 months. The problem is most marked among workers under the age of 35, where this figure rises to a massive 83%.

More than half (54%) of all age groups experiencing such stress indicate their productivity had fallen as a result. Again, the number increases to 61% among younger employees. The phenomenon is also more marked among men than women (63% compared with 50%).

Some 45% of financially stressed respondents say their sleep had been affected by the situation, leaving them more tired at work. A third are less able to concentrate. This means some are more error-prone and less able to make sound decisions (17% respectively). Some also find it more difficult to communicate effectively (14%).

Wellbeing is an essential part of high performance. Business leaders need to think about investment in wellbeing, not as an insurance against people falling ill tomorrow, but as a means of driving greater performance and productivity today.”

Gethin Nadin, Chief Innovation Officer, Zellis & Benifex

In other words, initiatives to tackle financial wellbeing are no longer simply a nice-to-have. There are clear business reasons why they must form a key element of wider wellbeing strategies.

How payroll supports financial wellbeing

This is where the payroll function comes in. Accurate and accessible payroll services play a central role in getting financial wellbeing right.

Put another way, if employers are serious about supporting employees, providing them with effective, easy-to-access payroll information is vital. Furthermore, having the right tools and processes in place makes it simpler to track the impact wellbeing initiatives are having on performance.

About 8 in 10 employees are not completely confident of being able to understand every aspect of their payslip or being able to spot an error. Payslips include many acronyms and specific financial terminology. Employers often fail to offer sufficient explanation or access to help.

To make matters worse, employees who lack confidence with numbers or have low numeracy skills already find it much more difficult to understand their pay and manage their finances. This situation can have a negative impact on their productivity and overall wellbeing.

Nearly half (44%) of employees say a mistake with their pay would cause them to experience financial difficulties, such as not being able to pay the bills on time. Some 46% indicate it would make them more stressed and anxious too.

Educating employees on pay is actually a way for employers to mitigate risk. It ensures that employees have the necessary knowledge to check payslips and immediately flag errors.

Payroll professionals can resolve such errors more quickly and minimise the impact, both on employees and the company’s reputation.

Optimising payroll services for financial wellbeing

Employers should establish and signpost simple, formal processes for employees to ask questions and raise concerns about their pay with payroll professionals. There should also be a a feedback loop to show that the system works effectively.

Just as important is that employers take full advantage of the functionality inherent in their payroll systems. This includes ‘hover-over’ functions that enable workers to get more information and context about items on their pay advice to understand why certain deductions have taken place.

For example, instead of just seeing an unexplained National Insurance deduction figure, the employee would benefit from a brief message explaining what this tax is and what it funds.

MyView PayNow financial wellbeing app

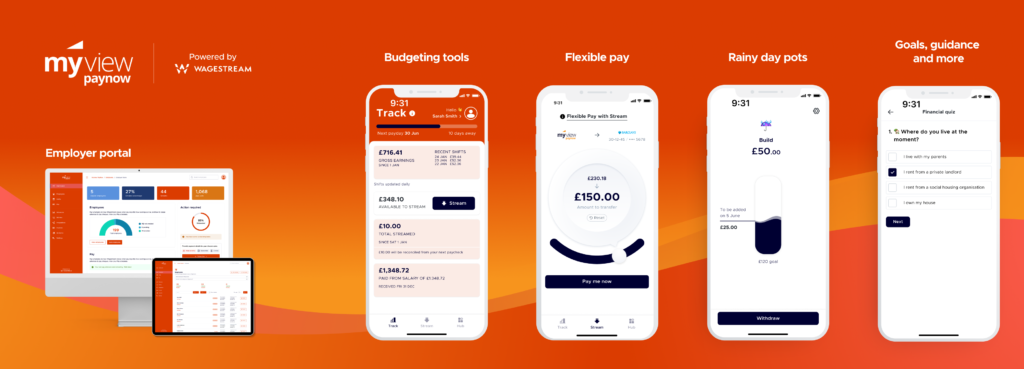

Other services that can make a big difference to employees’ lives are MyView PayNow and Work Report.

MyView PayNow is a financial wellbeing app developed with our partner Wagestream. It enables employees to access up to 50% of their earned wages instantly for a fixed transaction fee. This flexible pay approach is also known as earned wage access. 72% of employees surveyed by Wagestream felt more in control of their finances as a result of using it.

The app’s pay and spend budgeting tool helps staff manage their finances more effectively too. They can see in one place how many shifts they’ve worked and how many are due, their expected pay, and what they have spent.

Another advantage of MyView PayNow is that it supports employees to build up a rainy-day fund or save for a specific life goal. This is particularly valuable at a time when 35% of people in the UK have less than £100 in savings.

Once individuals set a goal and a deadline, the app’s Build function simply calculates the relevant monthly contribution and automatically moves it to their savings pot on payday. People can save up to £100 per month, up to a total of £1,000. They can access the money instantly if required. There is also a monthly prize draw to encourage them to continue managing their money wisely.

Work Report for employment and income verification

Work Report is an online employment and income verification service, provided by our partner Experian.

It gives employees an instant, automated means of confirming their personal information to potential lenders, for example during a mortgage or loan application.

Such information includes their employment status, salary and whether their income is stable or not. This enables lenders to determine whether applicants are in a position to keep up repayments.

The system works by automatically extracting the minimum amount of data from your payroll system and sharing it instantly with the lender. This inevitably saves time and effort for everyone.

Conclusion: Payroll is pivotal to financial wellbeing

In today’s challenging economic landscape, payroll has stepped up from behind the scenes to become a powerful ally in supporting employee financial wellbeing. When organisations implement user-friendly payroll systems with clear explanations, open communication, and innovative tools like on-demand pay access, they help lift a significant weight off their people’s shoulders. These thoughtful approaches don’t just reduce financial worry—they create a positive ripple effect where employees can focus better, sleep sounder, and bring their best selves to work. The result? A workplace where people and business thrive together, proving that when we take care of financial basics, everyone wins.

Key takeaways

- Financial stress significantly impacts workplace productivity, with over half of affected employees reporting decreased performance and 45% experiencing sleep disruption.

- Clear, accessible payroll information is essential, as approximately 80% of employees lack complete confidence in understanding their payslips.

- Innovative solutions like MyView PayNow enable employees to access earned wages before payday, with 72% of users reporting greater financial control.

- Educational elements within payroll systems help demystify financial terminology and empower employees to spot errors promptly.

- Automated verification services streamline processes for employees seeking loans or mortgages, reducing administrative burden and supporting major life decisions.

Ready to support employee resilience and productivity?

The payroll function can, and should, act as a key hub for effective financial wellbeing initiatives. Making this a reality requires an advanced modern payroll system and the right complementary services.